what does it mean to be tax deferred

Deferred tax liabilities and deferred tax assets. A tax-deferred annuity aka a tax-sheltered annuity is a long-term investment account designed to provide regular income payments after retirement similar to a pension.

New Irs And Ftb Requirements On 1031 Tax Deferred Exchanges 2014 Www Westcoastescrow Com Escrow Escrow101 Propertytaxes Home Escrow Irs Home Selling Tips

Now that you know what tax deferral is and.

. Tax-exempt accounts are useful if your income will be higher. Why Does Tax Deferred Matter. Most companies normally prepare an income statement and a tax statement every.

Popular tax-exempt accounts are Roth IRAs and Roth 401 ks. An annuity is an investment vehicle that combines features of insurance and investment and can provide tax-deferred growth. Tax authorities charge taxes based on tax laws and the two often differ.

Both will appear as entries on a balance sheet and represent the negative and positive amounts of tax owed. The IRS will want its share of that gain through taxes. Ordinarily all contributions dividends and gains generated by an investment account are subject to tax.

Traditional IRAs are also tax deferred so even if your employer doesnt offer a 401 k you can take advantage of. Deferred tax can fall into one of two categories. Real estate investments may defer certain taxes including capital gains and depreciation recapture via a 1031.

A deferred tax liability is an account on a companys balance sheet that is a result of temporary differences between the companys accounting and tax carrying values the. Common tax-deferred retirement accounts are traditional IRAs and 401 ks. Employer F then reduces this federal tax liability by 3500 for eligible sickness benefits leaving a federal deposit obligation of.

This temporarily results in a remaining federal deposit requirement of 7500. For example if you purchase a property for 300000 and five years later sell it for 350000 the gain will be 50000. Tax-deferred status refers to investment earnings such as interest dividends or capital gains that accumulate tax free until the.

Companies calculate book profits using a particular accounting method. The main tax-deferred retirement accounts are the 401 k and the Individual Retirement Account IRA. Tax deferred is an instance where investment earnings such as interest dividends or capital gains accumulate tax-free until the payment of taxes related to the investment is triggered by some taxable event in the future.

Deferred tax DT refers to the difference between tax amount arrived at from the book profits recorded by a company and the taxable income. Deferred Income Tax. Deferred income taxes impact the future cash flow of the Company ie if its an asset the cash outflow will be less and if its a.

The poem Dream Deferred by Langston Hughes is one mans expression of his dreams during a difficult time periodAs a black man in a time period where African-Americans were considered an inferior group of peopledreams and goals would have been difficult to realize. What Does Tax Deferred Mean. All qualified retirement plans allow taxpayers to defer taxes on contributions and earnings.

The effect arises when taxes are either not paid or overpaid. The money in your 401 k will have grown over the years but instead of being taxed at 25 if you had kept it as income it will be taxed at a lower rate during your retirement. While tax deferral does help you grow your assets quicker that isnt the point.

Qualified annuities also provide the benefit of delaying taxes. Having a bunch of money is nice but having significantly greater retirement income is really what this is all about and actually much more important. In all cases tax deferral is a powerful incentive for people to include these tax-favored vehicles as part of their retirement plan.

The deferred tax represents the negative or positive amounts of tax owed by the Company. The two main types of tax-deferred benefits for American taxpayers are some annuities and some retirement accounts. Note that there can be one without the other - a company can have only deferred tax liability or deferred tax assets.

Deferred tax is a balance sheet line item which is recorded because the Company owes or pay more tax to the authorities. Secondly what does the speaker mean by dream deferred. Tax-deferred growth is investment growth thats not subject to taxes immediately but is instead taxed down the line.

It is important to note that tax deferred is not the same as tax exempt which refers to the absence of applicable taxes. Tax exempt means taxes are never assessed on the investment in the first place. Tax deferral is a powerful way to increase your retirement income.

The primary benefit of tax deferral is that your earnings grow tax-free until the day you make your first withdrawal. The term deferred tax refers to a tax which shall either be paid in future or has already been settled in advance. These taxes are eventually returned to the.

Herein what is a dream deferred mean. Deferred Tax Liability. Gains on investments also called capital.

These costs can take a serious bite out of your long-term savings especially in a high tax bracket. Deferred tax asset is an accounting term that refers to a situation where a business has overpaid taxes or taxes paid in advance on its balance sheet. Remember tax deferral means taxes are assessed but payment is delayed.

In this article we will see why a company may differ its tax to a subsequent fiscal year or why a company may choose to pay the tax in advance. Employer F initially deferred the employers employers filing of 1500 in social security tax under section 2302 of the CARES Act. As stated earlier most 401 ks are tax deferred.

Tax-deferred does not mean tax-free. Perhaps the most common example of tax-deferred growth is that which youll. However if an employer was eligible to defer 20000 for the payroll tax deferral period but it paid 15000 of the 20000 and deferred 5000 for the payroll tax deferral period the employer does not need to pay any additional amount by December 31 2021 since 50 of the eligible deferred amount or 10000 has already been paid and is.

A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and accounting methods. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment.

Are Tax Savings For Small Business 401 K Plans Overstated How To Plan Small Business 401k Small Business

Tax Guide For Rental Investments Side 1 Tax Guide Investing Rental

If You Are Worried About Paying For Retirement It Is Worth Evaluating The Pros And Cons Of Annuities Variable Annuities Annuity Annuity Quotes

Deferred Tax Liabilities Meaning Example Causes And More Deferred Tax Accounting Education Accounting Basics

Tax Deferred Investment Account Investment Accounts Investing Investment Companies

Your Tax Refund How Will You Spend It Infographic Tax Refund Finance Investing Ira Investment

Savvy Tax Withdrawals Fidelity Lifetime Income Saving For Retirement Tax

If You Are New To Business Or Investing Generational Wealth Is The Book For You The Book Begins With Inspirational Wo Investing Tax Money Economic Development

Take Advantage Of The Window Of Opportunity Between Accumulation And Distribution In Retirement Use Partial Roth C Finance Investing Conversation Deferred Tax

Finance With Gerald Dewes When Must Taxes Be Paid On Ira And Employer Sponsored Retirement Funds Retirement Fund Tax Deductions Traditional Ira

What Is A Traditional Ira Traditional Ira Investing Tax Money

Tax Accounting Meaning Pros Components And More In 2022 Deferred Tax Accounting Accounting And Finance

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

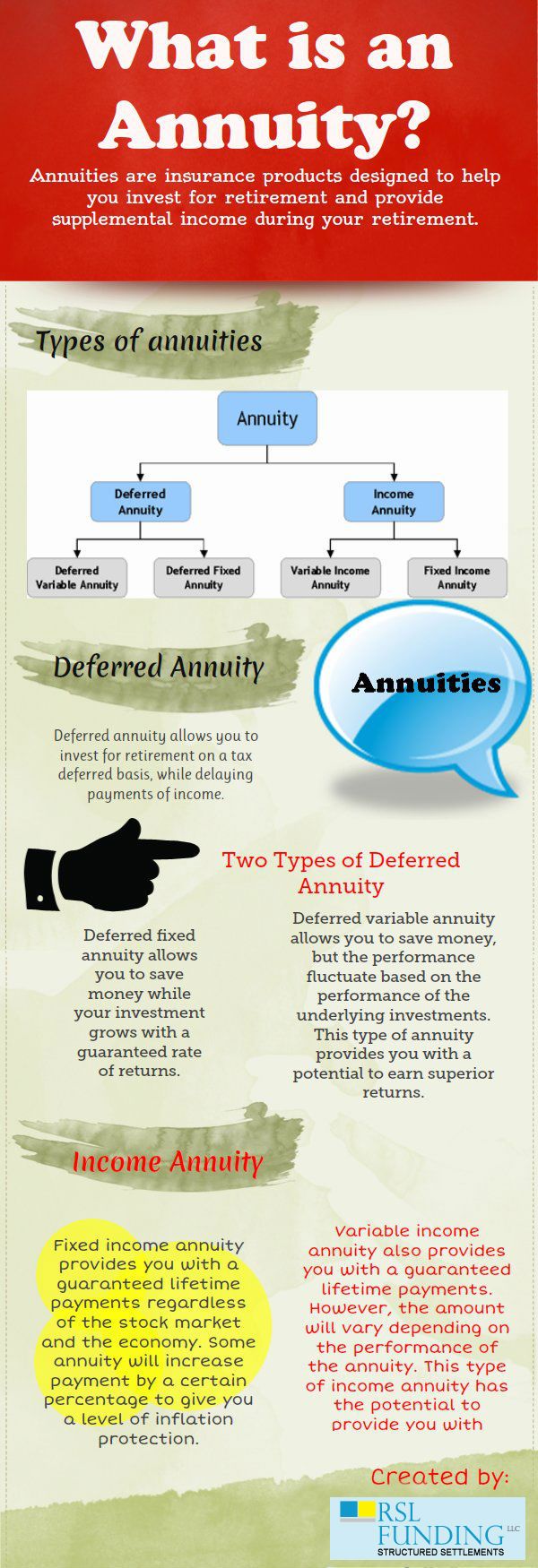

What Is An Annuity Investing For Retirement Annuity Finance Investing

An Rrsp Lets You Save For Retirement Your Money Grows Tax Deferred It Helps You Sav Life And Health Insurance Retirement Savings Plan Saving For Retirement

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

Saving 10 Day For 30 Years At 8 Tax Deferred Acct Can Make You End Up With Almost 500k Of Savings Apri Financial Literacy Money Management Advice Financial

Deferred Tax Meaning Accounting Class

Finance Primerica Definition Irs What Is A Ira Definition Individual Retirement Accoun Individual Retirement Account Personal Finance Retirement Accounts